Morrisons turns down a £5.5bn takeover tactic from US buyout giant Clayton Dubilier & Rice

The supermarket group’s shares increased by more than 30%, it was revealed over the weekend. After being presented with the 230p-a share proposal from CD&R, the supermarket’s shares hit a high of 237.5p. CD&R also pledged to deliver Morrisons shareholders with the 5.11p-a-share dividend announced by the company on 11 March. It would not be surprising if the deal goes through after CD&R meet the current market share price.

The weekend after the breaking news, it was recorded that the group’s market value rose by more than £1bn. Competitors Sainsbury’s and Tesco also increased, adding 4% and 2% respectively.

The popular supermarket chain chose to rebuff the shock takeover bid from the US private equity firm following the advice of former Tesco CEO, Sir Terry Leahy. He suggested the move could spark approaches from contending bidders or Amazon, which already has an online partnership with Morrisons.

Meanwhile, British supermarket giant, Asda was sold for £6.8bn in a private equity deal group, TDR capital. This was led by brothers, Mohsin and Issa Zuber who made billions when they founded their Euro garages business in 2001.

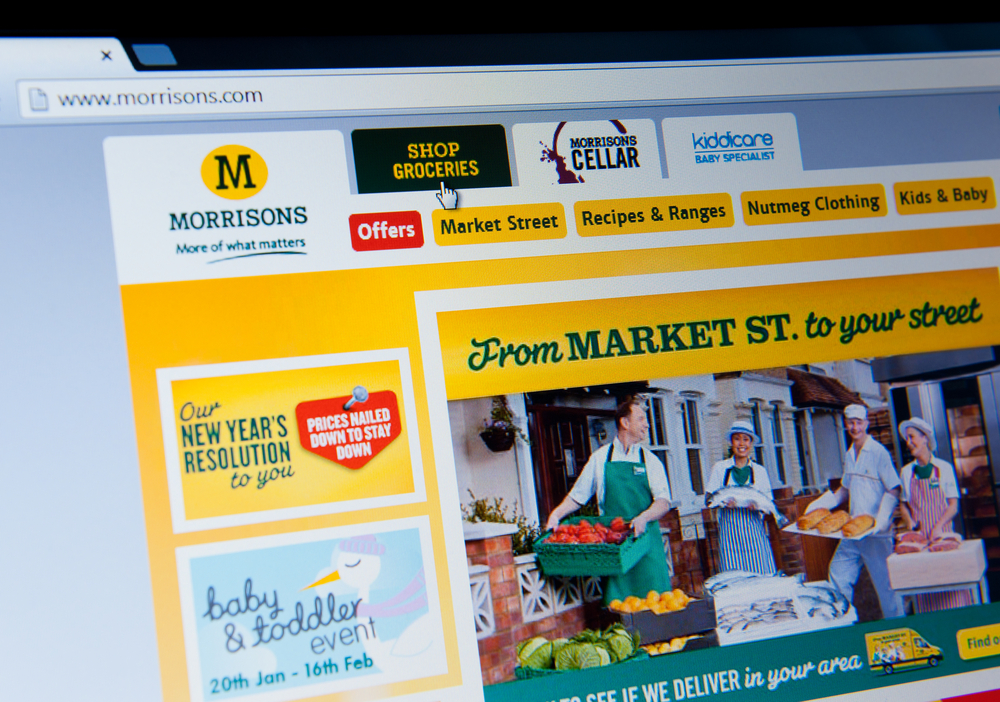

To reiterate, Morrisons is the UK’s fourth largest supermarket chain and has a large quantity of asset backing. It owns 85% of its 497 UK supermarkets, as well as 19 manufacturing sites and slaughterhouses. This is where it processes and packages a vast part of the bakery products, seafood, meat, fruit and vegetables, flowers, and chilled products to be sold in its stores. Morrison’s hold’s titles of being the UK’s second-largest fresh food manufacturer and the biggest supermarket customer to British farmers.

This is just an insight into how supermarkets have been an essential part of serving communities during the pandemic. CD&R is an incredibly busy equity firm raising $16 billion of new money from backers. In comparison to the £5.52bn it has offered to Morrisons, it is a small percentage of what the firm can afford. Secondly, UK assets have been cheap for a period, with a predicted wave of UK company takeovers at an all-time high.

Morrison’s reputation for its high level of involvement in local communities would mean its takeover would be no doubt be up for discussion. The family business was founded by William Morrison in 1899 and later run by his son Ken in 1956. The company only reached the stock market in 1967 when Sir Ken’s current strategy of owning the majority of its food and packaging operations called ‘Market Street’ proved to be a great success.

Sir Ken cared deeply about his employees which currently stands at 117,000. Supermarkets like this certainly deserve owners from private equity firms that put the long-term interests of the business and its employees first. In light of this, CD&R’s ownership is keen to keep Morrisons management on board. Do you think this deal will be tempting if the price is suitable for shareholders?